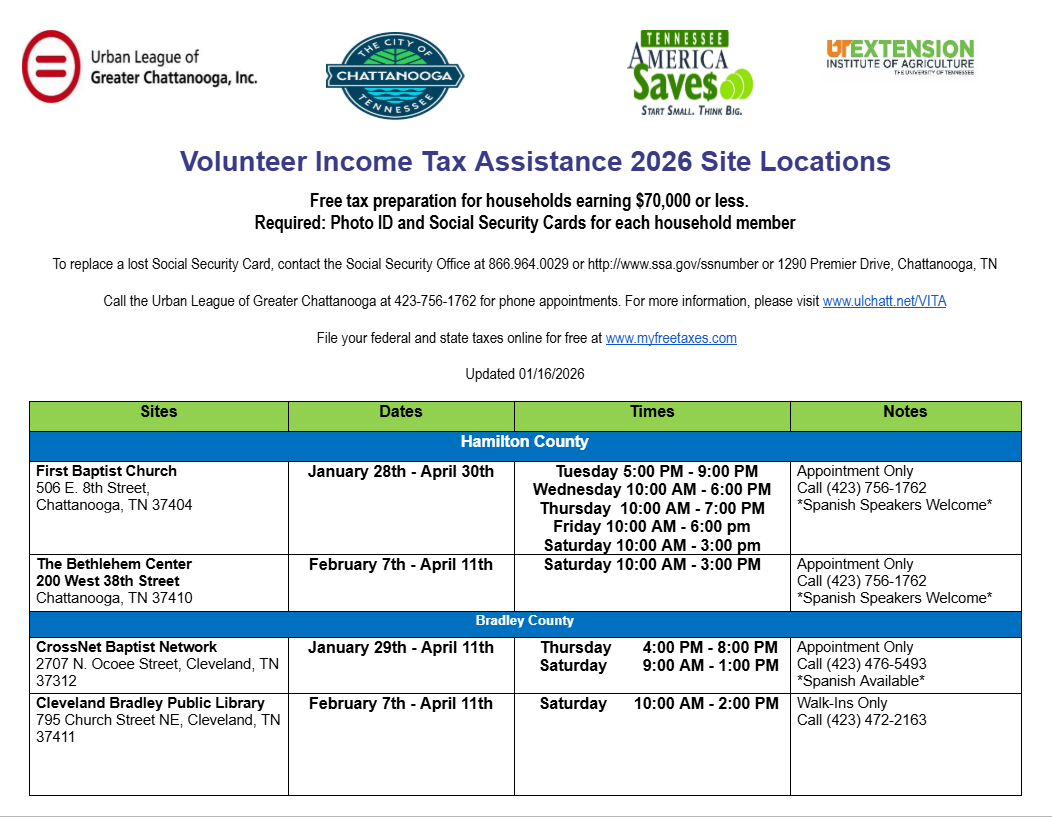

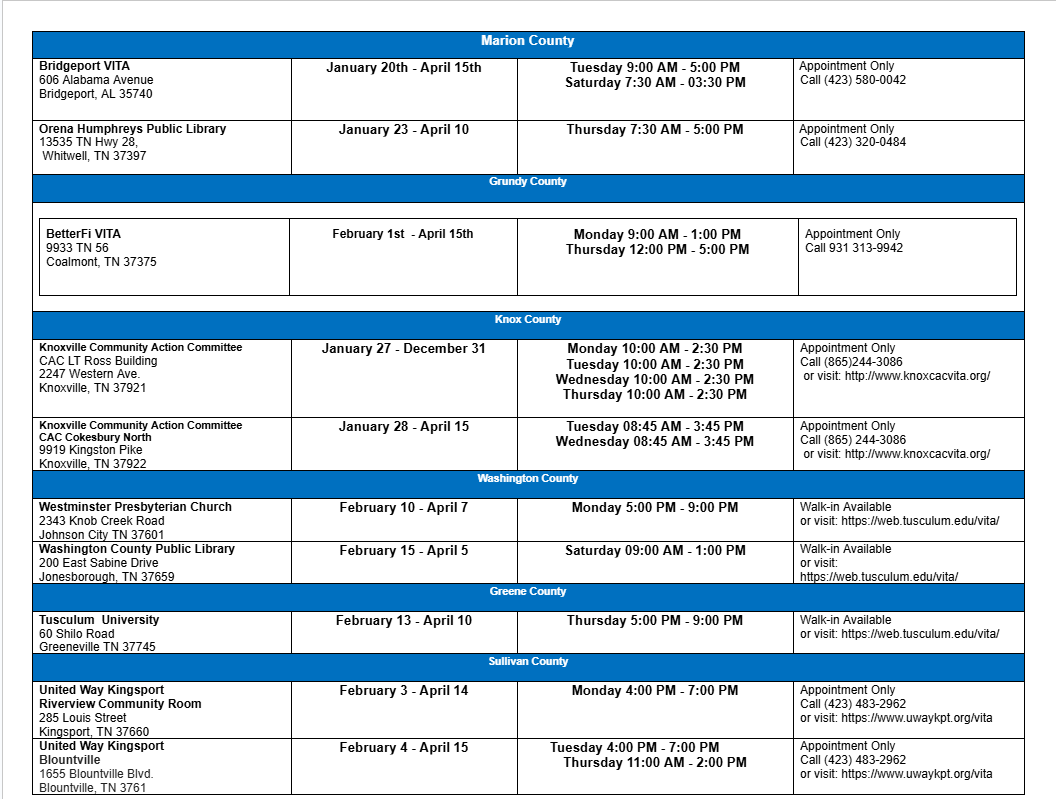

We are providing free tax preparation

for households under $70,000 through April.

Our Volunteer Income Tax Assistance (VITA) program will begin taking appointments on Jan. 20th, 2026, at 10 am.

Call us at 423-756-1762 to schedule an appointment.

You can file your taxes online for free at www.myfreetaxes.com